Our Thoughts on Inflation

We are going to talk economics…please bear with us, we will try to make this interesting!

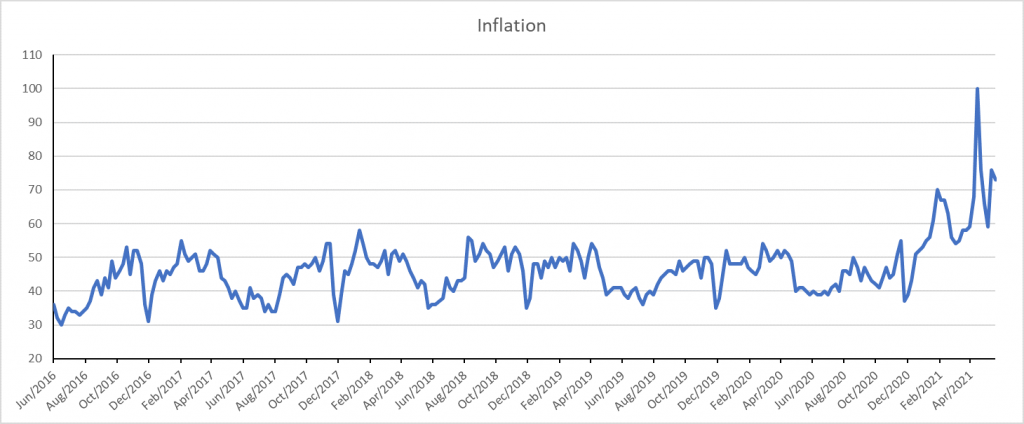

The above graph is not the inflation rate but a measure of the number of times the word inflation has been used in search terms and articles. Inflation is on the rise in all sorts of ways.

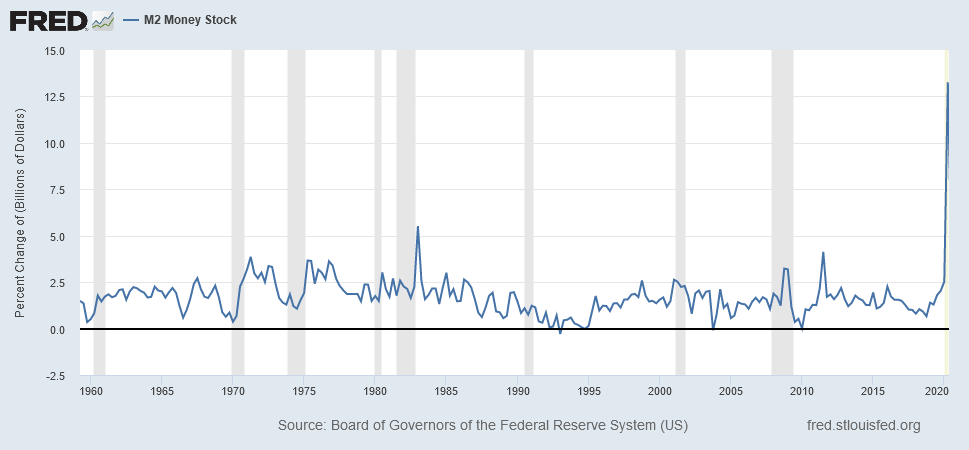

What is inflation? An academic economist will answer “Inflation is the decline of purchasing power of a given currency over time”. What causes inflation? The same economist will say “Inflation is always and everywhere a monetary phenomenon”. In other words, inflation can only be caused by a rapid increase in the quantity of money that outstrips the supply of goods. As the graph below shows, we have certainly seen a massive increase in the quantity of money created (aka money printing) in response to Covid.

Source: US Federal Reserve, Cavendish

The real world is more complex and demand needs to outstrip supply to cause inflation i.e., more buyers than sellers of any particular item. This is certainly true for lockdown items whether they are laptops, exercise bicycles, garden furniture or post lockdown spending such as used cars or a pint of beer. But the inflation data shows that it is more widespread than that.

Contrary to initial expectations Covid has been an inflationary shock. Supply chains have been disrupted whilst demand has been maintained by the scale of the extraordinary stimulus, the money printing referred to by the economist. This coupled with the fact that prices were very depressed 12 months ago means that year over year measures of inflation are showing a very strong rebound – US headline inflation at 5.0%[i] and UK at 2.1%[ii]. Most Central Bankers are taking the view that these effects will wash out over time and inflation is transitory.

There is also something strange happening in the jobs market. Many employers are having difficulty filling vacancies despite high unemployment. In the US there are currently 9.3m unfilled job vacancies and companies like McDonalds are having to pay people to turn up for interviews. Post pandemic many people have re-evaluated their work life balance with an estimated 2.6 million US workers opting for early retirement. Those that are in the workforce are seeing pay increases as a result.

Covid disruption explains a significant part of the jump in inflation but not all. We believe that there is a bigger change underway. Many of the factors that have contributed to the disinflation over the last two decades are now played out[iii]. Some of the most significant being the (gradual) reversal of globalisation, demographics (declining number of workers) and the under investment in fossil fuel production as we transition to net (carbon) zero.

The final element – economic orthodoxy has changed. No more talk of austerity as Governments look to stimulate growth and “Build Back Better” including substantial spending to meet net zero targets. In previous cycles Central Banks have raised interest rates to curb inflation and have “hit the brakes too hard” causing a recession. Central Bankers are moving to “average inflation” targeting regimes, maintaining loose policy for longer, allowing economies to run hotter to make up for past undershooting of the inflation targets (generally 2%).

Inflation is also a psychological phenomenon and the expectation of rising prices leads to rising prices as consumers are prepared to pay up for items and workers ask for and receive higher pay. We should not underestimate the impact of FOMO (Fear Of Missing Out) and YOLO (You Only Live Once) on consumer spending in a post-pandemic world.

As we at Cavendish Ware are not economists, we will come off the fence and make some predictions! Whilst flares are back in fashion (or so my daughter says) we are not returning to the hyperinflation of the ‘70s but the experience of the last two decades where inflation averaged 1.9%[iv] is coming to an end. UK inflation may spike towards 5% in the near term but is likely to average around 3%. This scenario allows for Central Banks and Governments to maintain accommodative monetary policies – and inflate away some of the enormous debt that now saddles most developed countries. We would not be surprised if newspapers started to refer to the 2020’s “boom”.

What does this mean for portfolios?

The clear loser is bonds, also known as Fixed Interest. The value of the future (fixed) interest payments is reduced by inflation and so all things being equal the price of bonds will fall in response to higher inflation. The longer dated the bond the greater the fall. Given that interest rates and bond yields are very low, courtesy of Central Banks the real yield (that is the interest rate less the rate of inflation) of most bonds are negative. We have been recommending for some time to reduce exposure to bonds; CW portfolios are currently very underweight to bonds whilst preferring short dated bonds and Inflation Linked (IL) bonds. IL bonds have their interest payments linked to inflation indices so have a degree of inflation hedging.

The impact on equities is less clear cut. A rapid shift to (higher) inflation expectations can lead to price volatility. The advantage of equities is that they give exposure to corporate profit growth which can benefit from inflation. Over time equities have historically been one of the better asset classes to hold in higher inflation regimes. The types of equities that typically do well in inflationary regimes are cheaper, value stocks, companies exposed to cyclical sectors and those companies that pay high and growing dividends. Conversely companies valued on the promise of future profits tend to suffer as even if the profits materialise in the future, inflation will erode their value. Typically these are often technology and consumer companies. Again, we have been positioning the portfolios towards these value companies and away from expensive companies.

Intuitively cash is not a good asset to hold in inflationary regimes and it is true that its value is eroded over time. However, cash is not at risk of a drop in price due to a change in inflation expectations.

Commodities have traditionally provided a good hedge against inflation as they are both causative and correlated to inflation pressures. This effect could be compounded by the demand for commodities (particularly metals like copper) in the shift to net zero. We are considering adding commodity exposure to the portfolios alongside the gold holding.

One area we have considered and rejected is crypto currencies such as Bitcoin. Advocates of crypto currencies argue that they cannot be debased by money printing and so are good hedges against inflation, in effect a digital version of gold. However, they are highly volatile and driven by speculative flows rather than fundamentals. Even if we could access crypto (they are an unregulated asset) we believe that the current level of speculative trading and price volatility make them inappropriate for client portfolios.

In conclusion

We have been in a multi decade disinflationary environment. This has likely come to an end to be replaced by an era of higher (but not hyper) inflation. Equities will likely be the amongst the better performing asset classes but the winners in this environment will be different to those of the previous regime.

[i] US Consumer Price Inflation (CPI), 12 months to end May 2021

[ii] UK Consumer Price Inflation Harmonised (CPIH), 12 months to end May 2021

[iii] Space does not allow me to explore these in detail but I am happy to do so if any client is interested

[iv] UK CPIH. January 2000 to May 2021 Source UK Office for National Statistics & Cavendish Ware Ltd

Q1 2025 Market Commentary

Markets got off to a strong start in 2025, with US equities, building on last year’s momentum. Continued excitement around…

Bassline Episode 20

In this episode of Bassline, David Wallace speaks with Lance Peltz about the global economic landscape, focusing on recent developments…

Q1 2025 Investment Update

Overall, investors had a good year in 2024, with global stock markets benefiting from optimism over falling inflation, easing monetary…