Focus on Impact Investing

There has been much talk about a green recovery in a world still recovering from the effects of the pandemic.

Against this backdrop, Glasgow recently hosted COP26, the annual conference focused on limiting global warming to within a 1.5 degree increase compared to pre-industrial levels. The target of 1.5 degrees is based on scientific guidance that this will mitigate against a climate-based emergency.

Negotiations in Glasgow included phasing down the use of coal, moving to electric vehicles, and raising $100 billion annually to help developing countries with this transition. Beyond the rhetoric, what was clear is that there is growing determination through action and funding to keep the 1.5 degree target within reach.

As awareness of climate risk is raised, an ever-increasing number of investors want their investments to help address the issue.

Over the years, this type of investing has taken on different names, for example, Sustainable and ESG. The latest and most ambitious evolution is Impact Investing, investing in solutions contributing to both social and environmental issues.

The UN has 17 sustainable development goals (SDGs) and the steps to reach these objectives. These act as a global blueprint. Fund managers within the impact space can map how companies’ goods or services align to these goals.

The CW Impact Portfolio aims to promote the accessibility of investing in areas highlighted by UN SDGs.

The portfolio is managed similarly to our “core” CW portfolios, which we have been running since 2006, meaning all investments are subject to the same rigorous due diligence process that we use across the business. The difference within the Impact Portfolio is that we are actively seeking companies focused on solutions for societal needs. We are wary of ‘greenwashing’, which is when the social impact of an investment is exaggerated or mis-stated. We seek to ensure that the companies we invest in provide direct solutions or drive change.

We do this by assessing how much of a company’s revenue aligns with UN SDGs.

The following graphic depicts the alignment of invested company revenue with the 12 most investable SDGs:

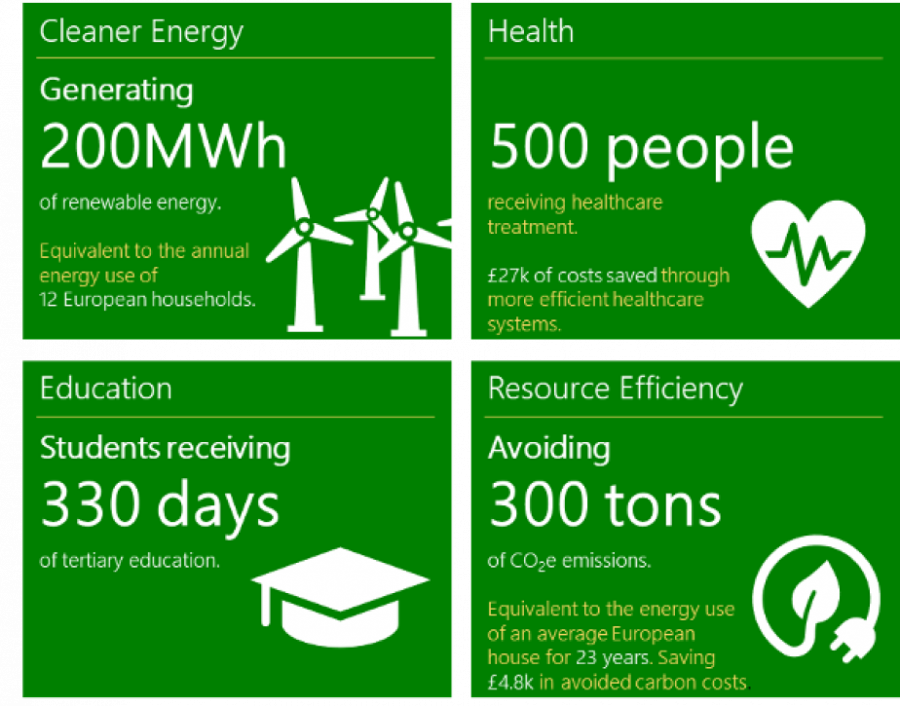

Since launch, the portfolio has also outperformed its investment benchmark*, returning 34.7% vs the benchmark’s 17.7%, through investing in assets that include renewable energy, healthcare, and education. The impact achieved by investment in just one of the underlying funds has included:

In summary, Impact Investing is a growing part of the investment industry due to the increasing desire for a “social” return and the more traditional financial return. Your investments can have an impact; the CW Impact Portfolio is designed to make investing in some areas where it is needed most accessible for all who wish to do so.

*Source: ARC Sterling Equity Risk PCI. Past performance is not a guide to future performance and this portfolio may not be suitable for everyone. Please contact us for further information.

Q1 2025 Market Commentary

Markets got off to a strong start in 2025, with US equities, building on last year’s momentum. Continued excitement around…

Bassline Episode 20

In this episode of Bassline, David Wallace speaks with Lance Peltz about the global economic landscape, focusing on recent developments…

Q1 2025 Investment Update

Overall, investors had a good year in 2024, with global stock markets benefiting from optimism over falling inflation, easing monetary…