Quarterly Investment Commentary Summer 2022

We have become accustomed to a world where politics and events didn’t really matter in economic and market terms. However, the economic impact of the war in Ukraine and the ensuing response is arguably unlike any war since WWII. Russia is the world largest supplier of energy (oil and gas) and is a significant producer of other essential raw materials from Nickel, Palladium, Platinum, Uranium grains (along with the Ukraine) to diamonds (apparently the world’s largest producer). The supply chain disruptions have also been compounded by China’s zero covid policy.

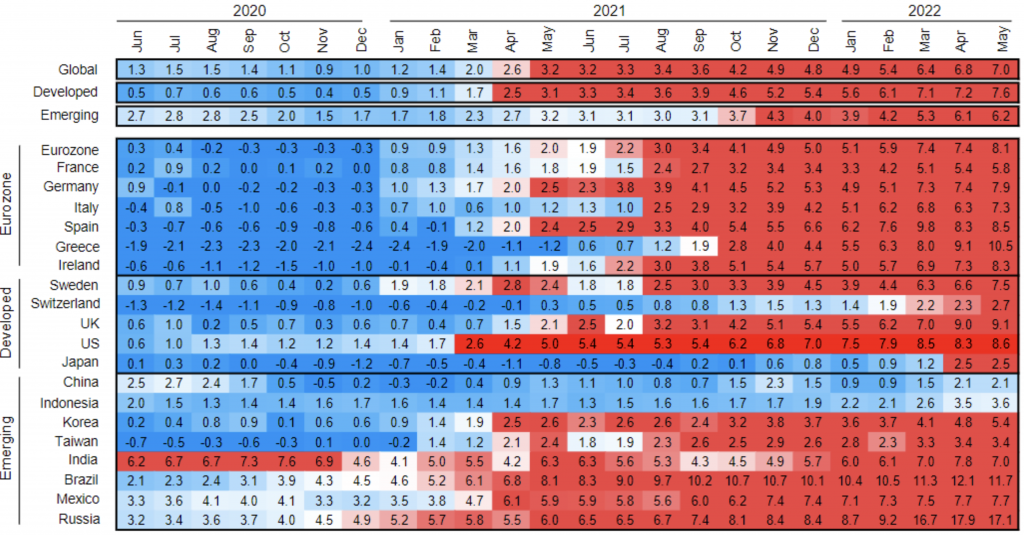

The upward pressure on inflation which we have written about for a while became a surge and the Central Bank mantra of “transitional” was well and truly debunked. What is even more important is that in many countries measures of core inflation (once volatile food and energy prices are stripped out) are also rising sharply. A heat map of global inflation pressures (courtesy of J.P.Morgan Asset Management) illustrates this.

Global Inflation, % Change year on year

Blue is below local central bank target, Red is above target.

Data as at 30th June.

Data as at 30th June.![]()

Across the world central banks have made it clear that controlling inflation will be their main focus as they aggressively raise rates and reverse Quantitative Easing (QE) to slow demand. Investors have sharply increased their expectations for the path of interest rates. Simply put…the cost of money is going up and the volume is going down.

In such an environment the price investors will pay for a company’s future earnings and dividends comes under pressure and across the board equity markets and bond market fell. Even commodities fell as the war surge was unwound as investors were concerned about economic slowdown reducing demand for industrial metals. Over the quarter the FTSE All Share, supported by the high exposure to oil stocks fell – 5.0%, the S&P500 fell 16.9% (US$ terms) and Emerging markets fell -10.3% (US$ terms). The Dow Jones Commodity Index fell -3.7% (US$ terms) although the energy component was up 12.6% (US$ terms). Bonds fared little better with Gilts (UK Govt bonds) falling -7.4% and US Treasuries falling -3.6% (US$ terms). Sterling fell -7.7% against the US$ (actually more US$ strength than sterling weakness) boosting returns in Sterling for overseas assets.

The end of the world is (probably) not nigh…..recession risk has definitely risen from insignificant at the start of the year to meaningful in most countries. But it is not guaranteed. Consumer confidence surveys are at or near record lows yet activity, whilst slowing, remains robust and at odds with the survey data. That is because unemployment is low and household savings are high, albeit declining.

Where we do have concerns is about the level of profits growth over the next year or so. Companies are being squeezed by rising costs of materials and labour and at the same time will see a decline in their sales or revenues. The market has already punished companies trading on expensive valuation (i.e. Technology and Covid winners) or companies who do not yet make a profit. However, there remains scope for further declines as profits disappoint. More positively, equity valuations have now fallen markedly, in many cases to below their long-term average, which suggests that there are still pockets of value to be found in markets other than the US, where valuations remain high despite being the worst-performing equity market this year.

We have continued to move the portfolios in a more defensive stance reflecting the balance of potential future scenarios. We are also happy to have some dry powder i.e. cash to deploy at a future date even if that risks missing out on any short-term rallies.

This actually feels more like a traditional economic and profits cycle (albeit with a large external shock) than a global financial crisis. There is good reason to believe that banks are well capitalised but (to mangle another saying, this one by Warren Buffet) as the liquidity tide goes out we will see who has been swimming naked.

Some thoughts on recent market turmoil

This week has seen investment markets in the news and we felt it would be useful to share our thoughts.…

Everything must change for everything to remain the same

At the start of the year, we mentioned that 58% of the world’s democratic population were facing elections. To that…

Q1 2024 Investment Update

The first quarter continued the positive momentum that we saw at the end of 2023. Economic forecasters once again demonstrated…

In the wrong funds? One point in your life when you should definitely check

Clients have fed back to us that one aspect they value in our service is stopping them doing stupid things!…